Search

[wpdreams_ajaxsearchlite]Virtual Green Card

What are the benefits of a Virtual Green Card?

- Can be used with more than 35.9 million online Mastercard merchants worldwide.

- We donate 0.2% of every transaction to the Eden Reforestation Projects.

- Reusable by reloading with an amount of your choice.

- 2 months free trial.

- The safety of your money is guaranteed because the money is kept in protected accounts that is only accessible by you.

- Order easily and use the card immediately.

Why am I paying activation costs for the Virtual Green Card?

The costs we charge are for the following points:

- Activation of your card account;

- Costs for using the worldwide Mastercard network;

- and a little margin so that we can also earn something 🙂

After activation, your Getsby Virtual Green Card is valid for 3 years. Starting after the 2nd month, a monthly service fee will be charged as long as the balance is sufficient.

What is a Virtual Green Card?

A virtual Mastercard card is a digital payment card that gives you online access to the 16-digit card number, CVV number and expiry date. A virtual card saves space in your wallet, protects your bank and card details and gives you control over your online transactions. Use the card for online purchases at merchants where Mastercard is accepted. Or connect the virtual card to your Apple Pay or Google Pay for in-store payments. The Virtual Green Card is a reusable virtual card. The card can be reloaded several times with an amount you want and can be used for up to 3 years.

How can I top-up my Virtual Green Card?

Top-up using another credit- or debit card

You can easily top up your Virtual Green Card via your Card account. Press the “Card account” tab in account or log in directly to Getsbycard.dipocket.org. In your Card account you can add balance to your Virtual Card under the “Top up” tab. You can select a direct top-up using your debit- or credit card. Via this method you can top-up up to € 500 per load, with a maximum of € 1000 per day.

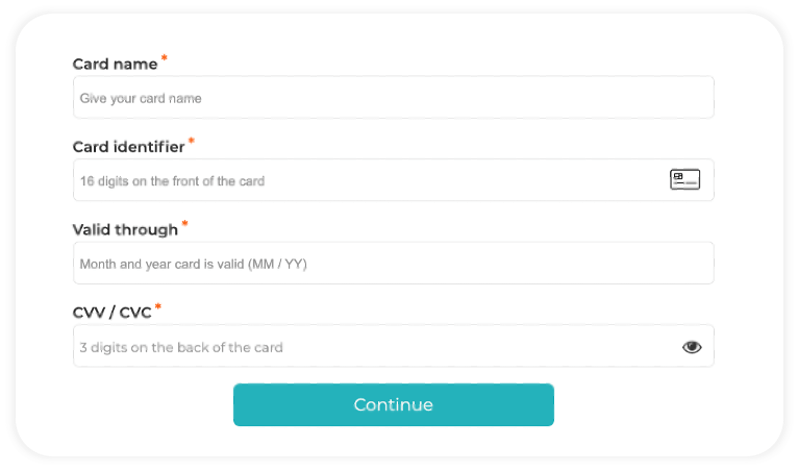

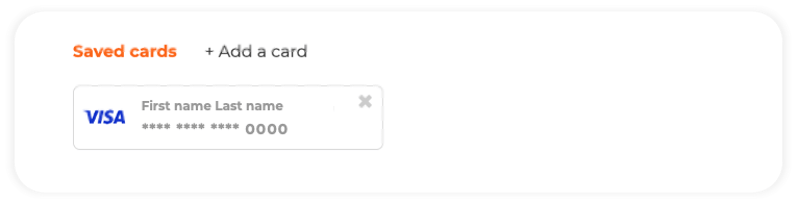

Steps to top-up using another credit- or debit card

1. Select the preferred amount to top-up your Green Card

2. Enter all your credit- or debit card details and press “Continue”

3. The top-up has been processed and the card is saved for future top-ups

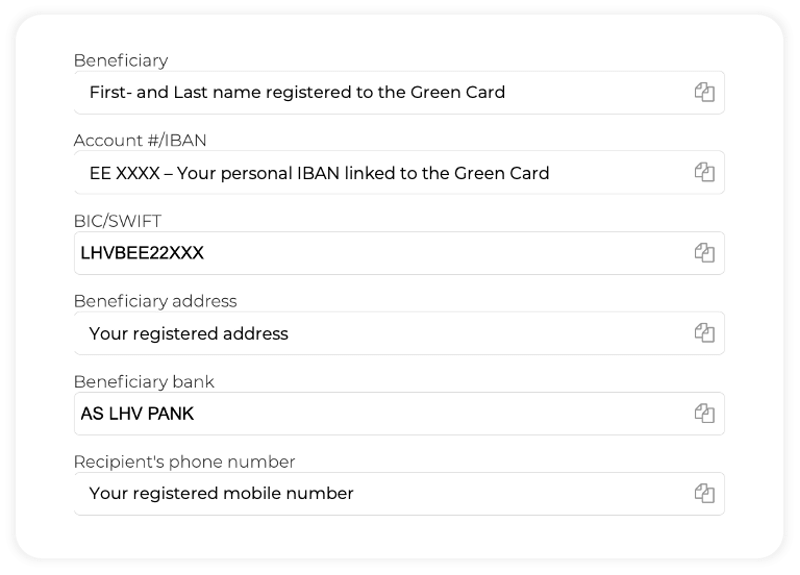

Top-up via bank transfer

If you opt for a bank transfer, a unique IBAN is visible for your account to which you can transfer your balance. You can top-up up to € 7500 per bank transfer with a maximum of € 7500 per day. The balance is generally added to your account on the same day.

Steps to top-up via bank transfer

1. Select the payment method “Bank transfer”

2. Here, you will see all information that is linked to your Green Card

3. To start the bank transfer, please go to your online banking app e.g. Revolut, N26 or Bunq and select “bank transfer”

4. Enter the top-up amount for the Green Card

5. For the beneficiary of the bank transfer, please copy the name of the recipient and add this to the transfer

6. Next, you copy the EE IBAN that is linked to your Green Card and also add this to the bank transfer

7. In case your bank requires a BIC/SWIFT, please enter DIUALT22XXX

8. You can now complete the bank transfer in your online banking app

9. After the transfer has been completed, it will take up to 1 business day* before the funds are added to your Green Card balance.

* During weekdays, SEPA transfers are credited to your account at the following times:

► 08:45 CET

► 11:15 CET

► 12:15 CET

► 14:15 CET

► 16:15 CET

► 16:45 CET

If the transfer occurs on a weekday after 16:45 CET, the amount will be credited on the next business day. Please note that transfers made during the weekend will be added to your balance on Monday morning.

Can I withdrawal cash?

This is possible in case you have a Virtual Green Card added to your Apple Pay or Google Pay. You can only withdrawal funds at ATMs that have a contactless symbol.

What are the costs to withdrawal funds?

The fee per cash withdrawal is € 2.00. This fixed fee applies to all withdrawals, anywhere in the world.

Can I top-up my Virtual Green Card with cash?

No, that is not possible. You can only top-up your card using a debit- or credit card and via bank transfers.

What card fees are there?

The fees that we charge are very transparent. Please find an overview of our pricing here

What are the limits?

Please find an overview of the cards limits here

Virtual Black Card

Why am I paying activation costs for the Virtual Black Card?

The costs we charge are for the following points:

- Activation of your card account;

- Costs for using the worldwide Mastercard network;

- and a little margin so that we can also earn something 🙂

After activation, your Getsby Virtual Black Card is valid for 1 year.

What is a Virtual Black Card?

The Virtual Black Card is a single-load virtual Mastercard card that you can use for one or multiple transactions until all funds have been spent.

The card gives you online access to the 16-digit card number, CVV number and expiry date. A virtual card saves space in your wallet, protects your bank and credit card details and gives you control over your online transactions.

Use the Black Card for online purchases at merchants where Mastercard is accepted. Or add the virtual card to your Apple Pay or Google Pay for in-store payments.

What are the benefits of the Virtual Black Card?

- Card information remains safe during a data breach and in cases of ordering from an untrustworthy website.

- The card can be used by more than 35.9 million Mastercard merchants worldwide.

- Super quick and easy to order.

- Perfect for single use.

- Protects your privacy thanks to the extra layer between bank account and merchants.

- After ordering and activation, your card can be used immediately as a means of payment.

Are Virtual Black Cards anonymous?

Using Virtual Black Cards ensures that you can pay discreetly online. The Virtual Cards are not linked to your bank account or credit card. As a result, transactions are not visible on your bank account, and the provider does not have access to personal (bank) details.

Does the 16-digit card number change after a transaction?

No, the 16-digit card number (PAN) will remain the same until the balance is used up or the card is closed. If you want to use a Virtual Black Card for a single purchase, simply transfer the remaining balance to your bank account for free.

Can I give a Virtual Black Card to someone else?

No, Virtual Black Cards are for personal use only.

What card fees are there?

The fees that we charge are very transparent. Please find an overview of our pricing here

What are the limits?

Please find an overview of the cards limits here

Virtual Mastercard Gift Card

Why am I charged an activation fee for the Virtual Mastercard Gift Card?

Our gift cards work differently from all other gift cards. This means that we not earn commissions on the funds spend with the gift card like our colleagues. This is why we have to charge extra costs for using the gift card. Please find the breakdown of the fee below:

- Activation of your card account;

- Costs for using the worldwide Mastercard network;

- and a little margin so that we can also earn something 🙂

After issuance, your Getsby Virtual Mastercard Gift Card is valid for 3 year with no additional user fees.

What is a Virtual Mastercard Gift Card?

Getsby’s Virtual Mastercard Gift Card is an international gift card. Companies can use the gift card for various purposes. As a gift to your employees, but also for other business relations. The Virtual Mastercard Gift Card can be used at more than 35.9 million online Mastercard merchants. And the recipient also has the opportunity to support one of the selected charities.

What are the benefits of a Virtual Mastercard Gift Card?

Benefits for the giver

As a Getsby giver, you give a gift that is suitable for any occasion. In addition, a Getsby can be spent at many locations, so that the user always enjoys this gift card

Benefits for the recipient

A Getsby can be used at more than 36 million online and offline locations worldwide. Use the card at your favorite (web)shops, restaurants, amusement parks, cinemas and much more. A Getsby is convenient to use. When spending, you only need to check whether Mastercard is accepted, and you can use your gift card.

Why is my online transaction being declined?

In the event that an online transaction is declined, this could be due to several reasons. Below we have listed the most likely reasons with the including the solution:

- The name, address or zip code in the card account does not match the information you enter on the website where you are trying to use the card – Check that all details are correct

- The total value of your purchase is higher than the balance on your gift card – Decrease the total amount to a maximum of the balance on your gift card

- Your gift card has not yet been activated – Complete the activation process

- You are trying to link your gift card to a subscription with a direct debit – Please pay the entire term in one go

- Your gift card is temporarily blocked – Contact our customer service

- You trying to transfer the balance to another payment provider such as Revolut, Monzo or bunq – This is not possible due to the restrictions from the issuing bank

How long is my Getsby Virtual Gift Card valid?

A Getsby Virtual Gift Card is valid for 36 months after issuance. The expiry date (“VALID THRU”) is visible on the back of the card in your card account. You should also use this date for online purchases.

Apple Pay

How can I do a contactless payment with Apple Pay?

There are different ways to do a contactless payment in-store using Apple Pay.

Pay with Face ID

Double tap on the power button on your iPhone and look at the screen. Hold your mobile with a short distance for the card reader and wait for the ‘Done’ notification.

Pay with Touch ID

To pay using Touch ID, put your finger on the home-button and hold your iPhone near the POS terminal. The payment has been approved when you see the ‘Done’ notification on your screen. You can also verify the payment using your iPhone access code.

Pay with Apple Watch

Double tap on the power button on your Apple Watch and hold the device near the card reader.

In which EU countries is Apple Pay available?

Apple Pay is available in the following countries: Germany, Austria, France, Italy, Spain, Finland, Ireland, Iceland, Greece, Liechtenstein, Luxembourg, Portugal, Slovakia, Estonia, Belgium, Poland, Norway, Netherlands, Slovenia, Sweden, Denmark, Switzerland and the UK.

Which Getsby Cards can be added to Apple Pay?

All Virtual Cards from Getsby are tokenizable, therefore they be added to Apple Pay.

Are there any extra costs for using Apple Pay?

Apple Pay is free of charge! You can simply use it without any concerns.

Google Pay

How can I do a contactless payment with Google Pay?

Paying with Google Pay works similarly to doing a contactless payment with your regular debit- or credit card. Hold your smartphone near the reader to process the transaction. Payments are handled in two ways.

Transaction up to € 50

Unlock your mobile by tapping the power button without opening the Google Pay app. Hold your phone near the NCF-reader and wait for the check-mark to know that the transaction has been completed.

Transaction above € 50

A payment above € 50 is almost identical. The only difference is that you will need to confirm the transaction using your PIN code, face recognition or fingerprint. Place your mobile close to the POS terminal and wait for the transaction to be finalized.

In which EU countries is Google Pay available?

Google Pay is available in the following countries: Austria, Belgium, Denmark, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, the Netherlands, Norway, Poland, Portugal, Slovakia, Spain, Switzerland and Sweden.

Which Getsby Cards can be added to Google Pay?

All Virtual Cards from Getsby are tokenizable, therefore they be added to Google Pay.

Are there any extra costs for using Google Pay?

Google Pay is free of charge! You can simply use it without any concerns.

Account

Am I allowed to open a Getsby account?

To be honest, we welcome every resident from the European Economic Area (EEA)/ European Free Trade Association (EFTA) / United Kingdom (GB) to join the club. However, you need to be at least 18 y.o. to be able to register and get access to our Virtual Cards.

Can I have more than one account with Getsby?

You can only have one account, but you can have more than one Virtual Card. You’re allowed to have one reloadable Virtual Green Card and up to 25 disposable Virtual Black Cards per month.

How do I register for an account on Getsby.com?

Simply enter your email address and preferred password on the registration page. After verifying your email address, you’re able to select a card or cards of choice. You then proceed to the checkout page where you will be requested to enter your personal details. Please be sure that all the personal details are correct. Once you purchase the card, your personal details will be linked to your account. When activation your first Virtual Card, you will be requested to verify your identity by providing 2 selfies, photo ID and proof of address. You should expect verification to be approved within ±30 minutes, after which you’re ready to go. Any subsequent card can be linked to your account without needing to go through the KYC process again.

How can I change my personal information?

Before ordering your first Virtual Card, you can change your personal information. After placing the order, your personal information is assigned to your account. Should you wish to update information, you will need to request to update your profile via contact@getsby.com.

I can’t access my account on getsby.com

If you’re unable to access your account, please reach out to us via contact@getsby.com.

Why do I need to verify my identity?

To activate your first personal Virtual Card from Getsby, you need to verify your identity. In order to comply with banking regulations, also known as ‘Know Your Customer’ (KYC) or ‘Customer Due Diligence’ (CDD, we have to identify our cardholders. We have to be 110% certain that our cards are not used for corruption, fraud or money laundering.

How do I verify my identity?

After receiving your first activation email, you will go through a one-time verification process. To complete the process, you need to:

- Make two selfies, one neutral and one smiling;

- Scan an identification document. This can be a passport, ID card or a full driver’s license. All details must be clearly visible on the scan;

- And scan a proof of address. The best way to provide this, is by uploading a pdf of your energy- or phone bill which is not older than three (3) months.

Some tips to get your identity verification first time right

- Make sure there is enough light in the room where you’re taking the photo

- Select the highest photo quality on the device you use to take the photo

- Do not cover any information on your identity document.

- Make sure both selfies are taken real-time

If we don’t accept your document:

- It may have some of the information covered. We need to see the full document photo page.

- It may be expired. Please check that your document is still valid before you upload it.

- Your details may not match. Please check that you have entered your name and date of birth correctly on the website.

- It may be a document type that we can’t accept, e.g a provisional driver’s license

My ID check was not approved. Why is that?

There a few possibilities why your documents where not approved. Please reach out to our team to help solve your issue quickly.

How to activate my card?

You can activate your first Virtual Card by going to getsbycard.dipocket.org/en/register. Should you wish to activate a subsequent card, you can easily add it to your account under the “link card” tab.

How do I receive my Virtual Card?

After registration on Getsby.com, you can order your Virtual Green Card or Virtual Black Card. After the purchase has been processed, you will receive the activation email within 2 minutes. In case it’s your first card, you will have to go through the KYC process. This normally takes op to ±30 minutes for approval. Any subsequent card can be linked and activated within seconds after you’ve received the activation email.

I haven’t received my activation email. What to do?

Did the activation email not arrive in your inbox within 2 minutes? We advise to check your spam and junk folder for activation@dipocket.org. If you still can’t find the email, just reach out to us so we can resend the code.

I’m not receiving the activation SMS.

That can be due to several reasons. Please contact our support team via this contact form.

I want to close my account. How can I do this?

Obviously, we are sad to hear that you want to close your account with us. However, it’s quite easy to do so. Simply go to “My details” in your account and select “Delete my account”. Enter your password and press “Delete my profile” to close your Getsby.com account permanently.

How can I delete my Virtual Cards and associated account?

Go to your registered card account and follow the next steps.

To start with, you should transfer all funds on your card to your bank account. This can be done via the “Offload funds” tab. Simply enter your IBAN and BIC/SWIFT, and the funds will be back in your bank account within 2 business days.

To delete your card account and have all your personal details and documents remove, simply go to your profile and select “Delete my profile”.

What is the minimum age for using Virtual Cards?

The minimum age is 18 years.

In which countries are Getsby Virtual Cards available?

The Virtual Green & Virtual Black Cards are available to residents of the following countries:

Åland Islands, Andorra, Austria, Belgium, Bulgaria, Czech Republic, Cyprus, Denmark, Estonia, Finland, France, French Guiana, Germany, Gibraltar, Greece, Guadeloupe, Guernsey, Hungary, Ireland, Iceland, Italy, Jersey, Croatia, Latvia, Liechtenstein, Lithuania , Luxembourg, Malta, isle of Man, Martinique, Mayotte, Monaco, Netherlands, Norway, Poland, Portugal, Romania, Réunion, Saint Pierre and Miquelon, San Marino, Saint Bartholomew, Saint Martin (French part), Slovenia, Slovakia, Spain, Sweden, Switzerland, Vatican, United Kingdom (UK), Wallis and Futuna.

Where can I use my Virtual Card?

That would be worldwide anywhere debit Mastercard is accepted.

Please be advised that our prepaid cards cannot be used for money transfers or for purchasing crypto currencies.

I would like to cancel my order. Is that possible?

It is no problem to cancel your order. We kindly ask you to submit the request via the contact form.

After receipt of the request, it takes 10 business days before the balance of the virtual card is in your bank account.

Please note that the activation costs or costs for payment methods will not be refunded in accordance with the terms & conditions.

Can I receive a refund on my Virtual Card?

You can receive a refund from a webshops on your card without any problems. We would like to address that in some cases it may take up to 10 business days before the balance is back in your account. This depends on the process the provider uses for refunds.

If the refund is not visible in your account after 10 business days, we recommend that you request the Acquirer Reference Number (ARN) from the provider. With this number we can retrieve the status of the refund in our system.

Can I receive a payout on my Virtual Card?

You can receive a payout from a website (e.g., gambling) on your card without any issues. We would like to point out that in some cases it can take up to 10 business days before the balance is back in your account. This depends on the process the provider uses for payouts.

Should the payout not be visible in your account after 10 business days, be sure to request the Acquirer Reference Number (ARN) from the provider. With this number we can retrieve the status of the payout in our system.

Why does PayPal set the default currency for my Virtual Card to RON/PLN?

PayPal selects the currency of your card based on their internal rules. Simply switch the currency to EUR when linking the card to your PayPal account to avoid a currency conversion fee.

In case the transaction is processed using PayPal without linking the card to your PayPal account, we advise to select the option to ‘Bill me in the currency listed on the seller’s invoice’. This way the transaction will be processed in EUR without a conversion.

Can I get a USD or GBP card?

At this time, we only provide EUR virtual cards for consumers. We will not launch USD or GBP cards in the foreseeable future.

Why is the available balance different in the account from the actual balance?

Transactions are not always processed directly by our processor. We advise to wait 10 minutes for the balance to be updated.

Why is my card is not accepted at crypto exchanges?

At this time, our issuing bank has blocked all crypto exchanges.

Can I get more than one Virtual Card?

You can have only one Virtual Green Card. Additionally, you can order up to 5 disposable Virtual Black Cards per day.

Where can I find my balance?

You will find the balance in your card account after registration or activation of your virtual card.

Is it possible to have a negative balance?

No. These cards are prepaid cards, so it’s not possible to have a negative balance. So you don’t have to worry about any debts.

Why is my payment being declined?

This can be due to many reasons. The most common reasons are:

- Insufficient balance

- Incorrect card details

- The name on file with the bank does not match the order details

- The merchant does not accept prepaid Mastercard cards

- Money transfers and crypto’s are blocked

If none of the above apply to you, please contact our support team for assistance.

I see a payment in my history that I do not recognize. What should I do?

You should block your Virtual Card in your account under the “Card” tab. It’s also possible to reach the 24/7 customer service by calling +370 5 208 4858. We will ask you to fill out this form and email it to cards.support@dipocket.org. You have 13 months to notify us of an unauthorized, non-executed or incorrectly executed transaction.

Contactless payments with Apple Pay/Google Pay aren’t working.

Please check if your Virtual Card has been fully enrolled into your e-wallet. Also be sure to check the setting of your smartphone to see if the NFC feature is turned on.

Giropay is not working to purchase virtual cards.

In some cases it is not possible to proceed the payment process using Giropay after trying to save your bank account details. To solve this issue, please clear the cache in your browser. To do so, please follow these steps.